The Census Bureau was undercounting business AI adoption

January Ramp AI Index update

Dear Colleagues: Today’s letter includes my monthly update of Ramp AI Index, our flagship research using spend data from Ramp to track how American businesses are using AI. As a subscriber, you will get my analysis before anyone else. I post on Substack first on the second Wednesday of every month at 10 a.m.

This week’s update focuses largely on the Census dataset we use to benchmark our results. New data on model adoption rates is available here.

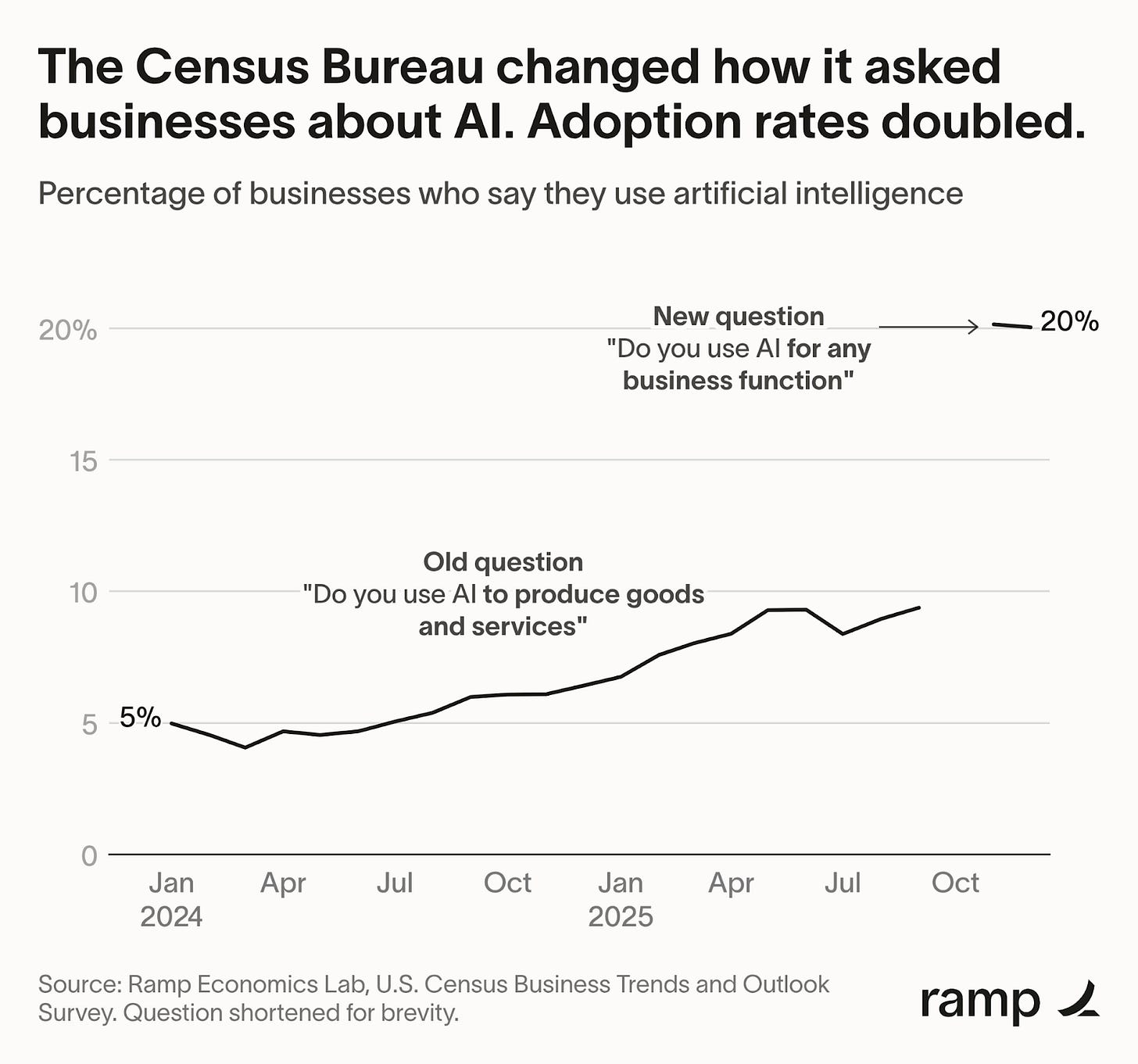

For nearly a year, I have argued that the U.S. Census Bureau significantly underestimates AI adoption by U.S. businesses (here, here, here, here, here).

For two and a half years, official government estimates stuck between 3% and 9%. This seemed implausibly low. Despite the technology’s rapid development over the last two years and clear signs of growing adoption, the official rate refused to budge. Meanwhile, private sector spend data, like Ramp AI Index, told a different story: rapid, substantial uptake. Today, Ramp’s data shows that 46.6% of businesses are using AI.

The difference is in the methodology. We use actual business spend data. The Census Bureau asks a question: does your business use AI to produce goods and services?

This question was odd because:

It is confusing econ-speak. “Goods and services” is vague to the average respondent. It is unclear how a software company, a primary beneficiary of AI, should answer, as they do not produce “goods” like a factory making widgets.

It ignores internal functions exposed to automation. AI is heavily used in finance, sales, and customer service. These job profiles are exposed to automation but not involved in direct production. By focusing on output, the Bureau missed businesses using AI to automate back-office workflows.

Last month, in its first report since the government shutdown, Census updated the question, and measured adoption doubled to 20%. The new version drops the “goods and services” language and simply asks whether businesses use AI for “any business function.”

The Census Bureau quietly confirmed the change in this pdf for pretty much the same reasons. Here are direct quotes:

“Respondents felt the question did not apply to their business as they did not see their business as a producer of goods or services and therefore did not consider the question applicable to their operations”

“Other respondents answered no to the AI question at first, but further discussion during the interview demonstrated they were using AI — in ways that were not directly connected to producing goods or services, but in other ways important for their business (for instance: using AI tools in the hiring process; assisting with project management, accounting, or R&D; or with AI tools provided as part of software workflows).”

Note these changes are not made without controversy at Census. Changing a question essentially renders all the previously collected data worthless. I spoke to a Census economist involved with this survey who was against the change because it means, essentially, starting all over again and losing the ability to track AI’s adoption rate increases from 2023–2025.

For what it’s worth, I support the change. Some critics will argue the new wording picks up “weaker” uses of AI because they’re not tied to production. I think that’s wrong. The so-called back office is where a massive share of U.S. work happens, and where AI is already changing tasks. The impact of AI on labor productivity will likely start in these job profiles. Our datasets should measure that.

Other big moves:

Ramp’s estimate of business AI adoption rose 1.6 percentage points to 46.6% of businesses in December, led by an increase in enterprise chat subscriptions and API spend with OpenAI. It’s the biggest month-over-month increase we’ve seen since July 2025.

OpenAI rockets back to record-high business adoption: The company reversed a downward trend (declining in two of the three preceding months) and reached a new record-high, growing adoption by two percentage points to 36.8% of businesses. OpenAI grew both paid subscriptions and API spend, according to line-item data from Ramp.

Anthropic’s growth continued to accelerate, growing 1.6 percentage points to 16.7% of businesses. Anthropic’s biggest spenders are in the tech sector and lean heavily on API spend.

Google increased adoption to 4.3% of businesses, slower than last month, but I’d again remind you we are likely undercounting the number of businesses using Gemini for free through their Google Workspace plans.

The financial services sector led all other sectors in growth, growing adoption three percentage points, but growth was broad across numerous sectors.

Something from my camera roll

BE_ON_CE

Take your guesses.

Another interesting article - thanks Ara!

Have you ever considered if the AI Index suffers from sampling bias? Specifically, I expect ramp customers to be more tech forward than companies that aren't using ramp (yet). These same tech forward companies are more likely to be using AI than others. If you only rely on ramp customer data, you may be overestimating the behavior of the overall population.

Thanks for this article. It would be interesting to understand causality more explicitly here. What the Census data most likely reveals is not just undercounting, but a category error: measuring AI adoption as “production” rather than as decision support, coordination, and internal work. That framing implicitly assumes value creation only happens at the output edge of the firm.

In reality, AI tends to show up first where judgment, throughput, and friction live: finance, sales, operations, hiring, and project work. These uses may look “weaker” on paper, but they are often strategically stronger, because they reshape how decisions are made long before products or services change.

Seen this way, the jump from single digits to ~20% is not a sudden adoption wave. It’s a delayed measurement finally catching up with reality.